|

|

|

|

|

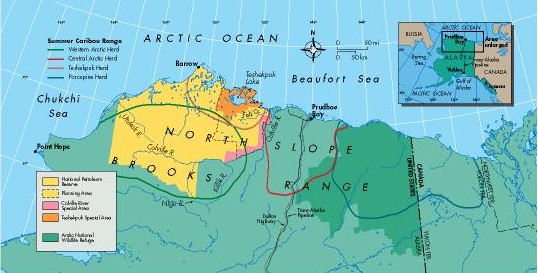

Challenging the status quo is never easy. In the1600's, Galileo suggested the earth was round. He was branded a heretic and imprisoned for his efforts. In the 1990's, the scientific community determined the burning of fossil fuels had an adverse effect on climate change. Oil companies called the science flawed and failed to embrace alternatives. Today, the damaging effects of fossil fuel are no longer in dispute. But that hasn't changed industry behavior. Just this week (2/27), a Republican energy bill was introduced in the Senate that embraced the status quo like a money launderer embraces an off-shore bank. The bill predictably pushes the industry-enriching policy of renewed exploration and drilling over the development of more sustainable alternatives. Nowhere is this more apparent than the recommendation to drill for oil on the coastal plain of Alaska's Arctic National Wildlife Refuge.  "America's Serengeti," as The Refuge has been called, is the rarest of things: a virtually undisturbed ecosystem. It has remained that way because Congress forty-one years ago - had the foresight to protect it. It is at risk today because somewhere beneath the permafrost of The Refuge there is oil. Opening up the coastal plain for drilling is part of a two-pronged policy. On one hand, it may help reduce America's dependence on foreign oil over the next fifty years. On the other, it will protect industry profits over that time as well. The alternative - promoting conservation and developing wind, solar and other renewable energy is not conducive to the current political climate. It can only reduce America's dependence on foreign oil. The oil projected from The Refuge represents a fraction of the oil consumption projected for America over the next half-century (around 10 billion barrels). Hardly worth the environmental wound it will cause. The National Resources Defense Council, for example, estimates that increasing fuel economy standards to 39 miles per gallon in ten years (the time it would take to produce the first drop of oil in The Refuge) would save 51 billion barrels of oil over the life of the proposed drilling. Even more disturbing is the industry's and Washington's willingness to pursue oil ventures in a pristine ecosystem over economically viable alternatives. This should make investors very uneasy. Despite twenty years of neglect from government and industry, renewable energy has achieved stubborn success from the hills of California to the Space Station orbiting the Earth. When the market barriers to renewable energy are finally razed, the growth in this segment will be staggering. What if, for example, Californians could recoup investment in solar panels by selling back to the grid excess energy at the same jacked-up prices Enron and Duke Energy charge. Thousands would do so and wealth would be created for individuals, not transferred to energy companies. Unlike oil production, renewable energy has the ability to boost GDP and reduce the current rate of environmental destruction. Oil companies refute this. They insist the economic benefits from oil production and environmental protection can co-exist. Unfortunately, oil production is an industrial process that relies on heavy machines, pipelines, tankers, trucks, airports, gravel pits, roads, workers and explosions. Environmental protection is the absence of those things. Many investors have already identified drilling in the coastal plain for what it is, a bad bet. Trillium Asset Management Corp., U.S. Public Interest Research Group and a broad coalition of concerned BP Amoco shareholders recently filed a resolution asking the company to assess the impact of drilling on the coastal plain. Last year 13% of BP Amoco shareholders voted for a similar resolution. Oil companies have done a good job of making money from oil in the past. It is now time to focus on the future. Investors don't need Galileo's telescope to see the future of energy does not lie 1000 feet below the coastal plain of Alaska. Blaine Townsend is the San Francisco Regional Manager of Trillium Asset Management Corp., the oldest and largest independent investment management firm dedicated solely to socially responsible investing. |

283 Water Street, 3rd floor, P.O. Box 2118, Augusta, Maine 04338 phone: 207-628-6404 fax - 207-628-5741 email: fen@powerlink.net